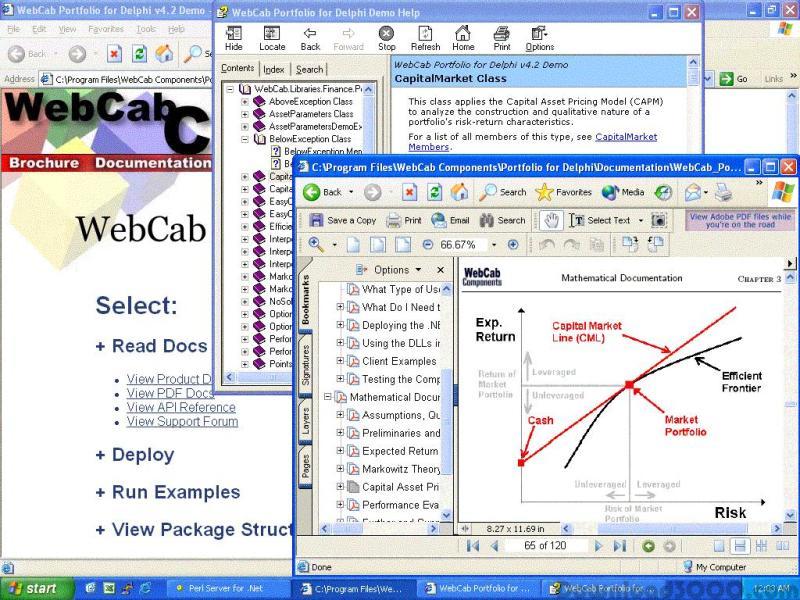

3-in-1: Delphi, COM and XML Web service implementation of Markowitz Theory and Capital Asset Pricing Model (CAPM) to analyze and construct the optimal portfolio with/without asset weight constraints. Also includes Performance Evaluation, interpolation procedures, analysis of Efficient Frontier, Market Portfolio and CML.

Publisher description

3-in-1: Delphi, COM and XML Web service implementation of Markowitz Theory and Capital Asset Pricing Model (CAPM) to analyze and construct the optimal portfolio with/without asset weight constraints with respect to Markowitz Theory by giving the risk, return or investors utility function; or with respect to CAPM by given the risk, return or Market Portfolio weighting. Also includes Performance Evaluation, extensive auxiliary classes/methods including equation solve and interpolation procedures, analysis of Efficient Frontier, Market Portfolio and CML. Utility Functionality included: Interpolation - Cubic spline and general polynomial interpolation procedures to assist in the study of the Efficient Frontier SolveFrontier - Solve the Efficient Frontier with respect to the risk, return, or the investors utility function. MaxRange - Maximum range of the constrained Efficient Frontier AssetParameters - Evaluation of the covariance matrix, expected return, volatility, portfolio risk/variance. Performance Evaluation - Offers a number of procedures for accessing the return and risk adjusted return (Treynors Measure, Sharpes Ratio). This product also has the following technology aspects: 3-in-1: .NET, COM, and XML Web services - Three DLLs, Three API Docs, Three Sets of Client Example all in 1 product. Offering a 1st class .NET, COM, and XML Web service product implementation. Extensive Client Examples - Multiple client examples including .NET (C#, VB.NET, C++.NET), COM and XML Web services (C#, VB.NET) ADO Mediator - The ADO Mediator assists the .NET developer in writing DBMS enabled applications by transparently combining the financial and mathematical functionality of our .NET components with the ADO.NET Database Connectivity model. Compatible Containers - Visual Studio 6, Visual Studio .NET, Borland's C++ Builder, Borland Delphi 3 - 2005, Office 97/2000/XP/2003 ASP.NET Web Application Examples ASP.NET Examples with Synthetic ADO.NET

Related Programs

Portfolio Performance Monitoring 3.2

Portfolio Performance Valuation Tracking

.NET Component for Markowitz Theory and CAPM

WebCab Portfolio (J2SE Edition) 5.0

Markowitz Theory and CAPM: Optimal portfolio

WebCab Portfolio (J2EE Edition) 5.0

Markowitz Theory and CAPM: Optimal portfolio

WebCab Optimization for Delphi 2.6

Solve local & global optimization problems.